Following the release today of a new national report outlining the negative impacts of potential GST changes on vulnerable and disadvantaged households, SACOSS has analysed the South Australian impacts written to Premier Weatherill and leading South Australian Federal MPs in all political parties asking that they not agree to any tax deal or any increase in GST unless:

- there is a broad tax reform package;

- the unfair income tax issues such as superannuation concessions, capital gains tax breaks and negative gearing are addressed;

- the overall effect of the changes is progressive before compensation is considered; and

- the reforms tie in with federation reforms which guarantee service delivery.

Spokesperson for SACOSS, Senior Policy Officer Dr Greg Ogle said

“We are concerned that some people are proposing increases to the GST as a one-off, fix-all for tax reform, when the report by the National Centre for Social and Economic Modelling released today by ACOSS shows that increases in the GST will impact disproportionately on vulnerable households.”

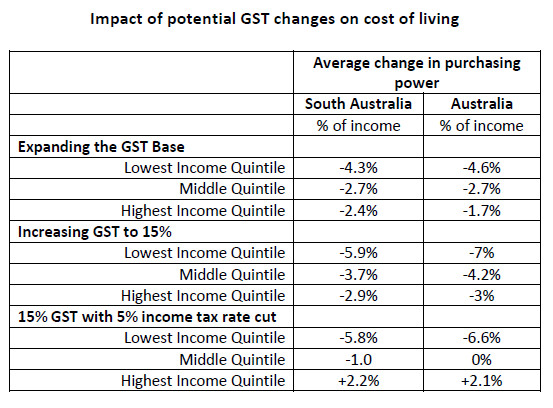

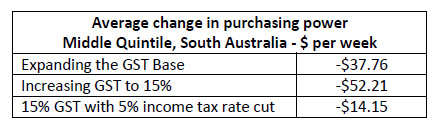

“The modelling shows that increasing the GST rate to 15% on the current base would increase the average living costs of the lowest 20% of South Australian households by 5.9% of their income, compared with 2.9% for the highest income quintile. These figures are slightly more equal than the national figures (7% for the lowest income households, 3% for the highest), but the SA figures still show that increasing the rate of GST is not fair.”

“It is a similar story if the base of the GST was broadened to include food, water/sewerage, health and education. The cost of living would increase by 4.3% for the lowest income SA households, but only 2.4% for those with the highest incomes.”

“Simply increasing the GST is an unfair way to meet the real challenges of funding health and other vital services into the future, and it is an inappropriate place to start (or end) tax reform. Tax reform should start by closing the loopholes in the progressive income tax system, and all South Australian MPs should insist on this before any GST changes are contemplated.”

“We don’t think it is too big a call for any tax reform package to be progressive overall, and that is why we are calling on South Australian MPs to ensure this is a bottom line in any national tax agreement.”

The ACOSS/NATSEM report can be downloaded at: www.acoss.org.au

Source: NATSEM modelling provided to ACOSS, November 2015.